By Marie Sullivan, legconsultant@wastatepta.org

View our comprehensive bill tracker looking ahead to week 12 here.

House and Senate Democrats released their proposed 2025-27 operating and transportation budgets on Monday, March 24th, held public hearings on Tuesday, and accepted amendments on Thursday. On Saturday, the Senate passed the operating budget (ESSB 5167) by a vote of 28-21 and the transportation budget (ESSB 5161) by a vote of 35-15. The House plans to take up the operating budget Monday, March 24th during floor session.

The two-year spending plan for the operating budget relies on revenue bills that are up for a public hearing on Monday in the Senate Ways & Means Committee, while the transportation budget relies on a 6 cent gas tax increase, among other fee increases. The House will hear revenue proposals on April 3rd.

Speak up and share your concerns with your legislators about fully funding K-12 education. If you haven’t already filled out the Action Alert, please do so today! Alert found here.

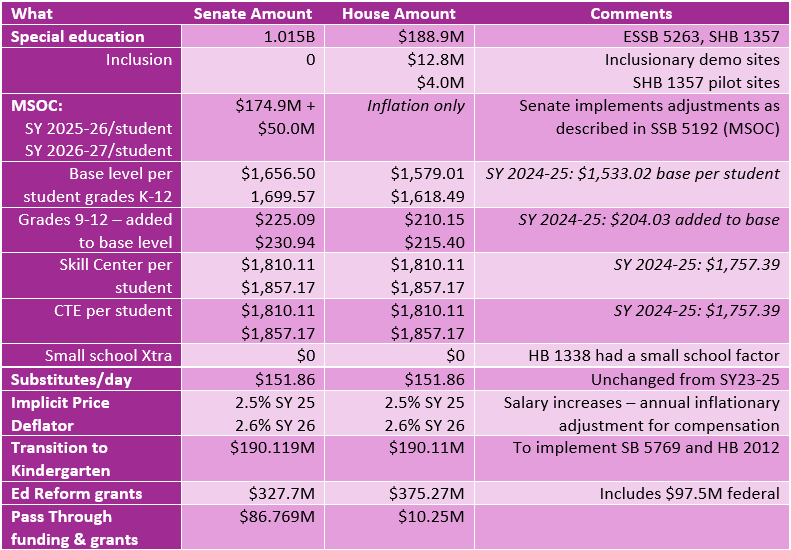

Here is a high-level review of the policy-level proposals for K-12 education funding:

The 2025-27 capital budget will be released Monday, March 31: House at 1 PM, Senate at 3 PM.

Policy bills to implement the budget for K-12

The following bills are designed to save the state funding but by no means constitute all the bills being considered by the Legislature for the 2025-27 biennial budgets.

House

- SHB 1489 would delay the Early Childhood Education and Assistance Program (ECEAP) entitlement from the 2026-27 school year to the 2030-2031 school year and would delay entitlement eligibility for families with incomes at or below 50% of the state median income until the 2034-35 school year. Also, would delay the Working Connections Childcare (WCC) program income eligibility expansion.

- HB 2012 would pause enrollment growth for the Transition to Kindergarten (TtK) program, holding enrollment for each school districts, charter school, or state-tribal education compact school to its 2024-25 school year enrollment. This means that if a district offered three classrooms of 18 students each, they would not receive funding for more than those students and a district that doesn’t offer TtK would not be allowed to offer a program and receive state funding.

- HB 2050 would reduce apportionment payments in 2026 by 1% in the months of February and March, and by 0.5% in April, and then add 2.5% in August. The bill also would reduce Local Effort Assistance (LEA) for school districts that exceed 33% of their students enrolled in online or remote Alternative Learning Education (ALE) programs. The reduction in LEA would equate to the percentage of students enrolled in ALE courses.

Senate

- ESSB 5752 would delay the ECEAP entitlement for eligible children from the 2026-27 school year to the 2030-31 school year. Several changes related to a family’s poverty level, income eligibility and other requirements that would take effect on July 1, 2026 would be moved ahead one year and take effect on July 1, 2025. Also, the bill would delay the WCC program by four years.

- ESB 5769 would limit the Transition to Kindergarten (TtK) program funding, beginning in the 2025-26 school year, to the funded level in the omnibus appropriations act. Growth could be allowed if funding was provided in the 2026 supplemental or 2027-29 omnibus budget. But under the bill, districts shouldn’t plan for enrollment growth for three school years: 2025-26, 2026-27, or 2027-28.

It also would direct OSPI to work with the Department of Children, Youth & Families to develop a recommended plan for phasing in the TtK program. The recommended plan must consider plans for the expansion of other state-funded early learning programs including, but not limited to, the Early Childhood Education and Assistance Program (ECEAP), and prioritize expansion for:

- Communities with the highest percentage of unmet needs;

- Childcare supply and demand;

- School districts, charter schools and state-tribal education compact schools with the highest percentages of students qualifying for free and reduced price lunch;

- School districts, charter schools and state-tribal education compact schools with high percentages of students with disabilities; and

- School districts, charter schools and state-tribal education compact schools with the lowest kindergarten readiness results on the Washington kindergarten inventory of developing skills (WaKIDS).

The plan must include a phased-in approach for expansion that does not exceed 5% growth in statewide annual average full-time enrolled students each year. The report is due December 1, 2027, which means no enrollment growth until the 2028-29 school year.

- ESSB 5772 would reduce Local Effort Assistance (LEA) for school districts that exceed 15% of their students enrolled in online or remote Alternative Learning Education (ALE) programs. The reduction in LEA would be 30% of students enrolled in online or remote ALE courses. The bill was amended on the Senate floor before passing 27-22. It has been referred to the House Appropriations Committee.

- SB 5780 would reduce school bus depreciation (reimbursement) payments for school districts that have been awarded grants or rebates to replace the same vehicle. Significantly, this would apply to school districts that have received a federal, state, or local grant to help cover the cost of an electric school bus or Zero Emission Vehicle, reducing the reimbursement payments by the amount of the grant.

- SB 5793 would make changes to students’ share of the educational costs at institutions of higher education. The bill would authorize tuition operating fees to increase up to 5% above the tuition growth factor, in academic year 2026-27. Regarding the Washington College Grant, the bill would continue eligibility for the award up to 65% of the median family income in academic year 2025-26; return eligibility for the award up to 55% for 2026-27; and limit income eligibility to 70% of median family income, beginning in academic year 2026-27. The bill also would limit the College Bound Scholarship award to within six years of receipt, beginning in academic year 2025-26.

How do the revenue bills factor into the overall K-12 picture?

As a reminder, the Education Legacy Trust Account (ELTA) is used to fund Kindergarten through grade 12 and higher education as well as childcare and early learning programs. The Common School Construction Account (CSCA) is appropriated through the biennial state capital budget to provide financing for the construction of facilities for common schools.

For the existing capital gains tax, the first $500 million in taxes, penalties, and interest collected from the state capital gains tax each fiscal year must be deposited into the ELTA. Any remaining proceeds are deposited into the CSCA. The amount deposited in the ELTA is adjusted annually for inflation.

The ELTA is funded through a combination of the estate tax, capital gains, and a portion of the real estate excise tax.

In the latest forecast, revenue in the ELTA was up:

“Forecasted Education Legacy Trust Account (ELTA) revenue has increased due to increases in forecasted capital gains, estate, and real estate excise taxes. The ELTA forecast has been increased by $29.9 million in the current biennium, $181.3 million in the 2025-27 biennium and $166.7 million in the 2027-29 biennium. Forecasted ELTA revenue is now $2.118 billion for the 2023-25 biennium, $2.483 billion for the 2025-27 biennium and $2.707 billion for the 2027-29 biennium.”

Most of the Education Legacy Trust Account – $4.5 billion – funds Part V (Public Schools, K-12) in the operating budget, but significant amounts also go to the Department of Children, Youth & Families, institutions of Higher Education, and the Washington Student Achievement Council.

Why is this important?

- The only tax proposals directly linked to K-12 education are the two property tax bills. WSPTA’s resolution supports progressive, predictable, stable and sustainable revenue. Property tax increases are not progressive.

- Rep. April Berg’s wealth tax would go to the ELTA, so there’s at least some link to K-12 education, but as stated above, the ELTA doesn’t only fund K-12 schools.

- While the Senate wealth tax and payroll tax and B&O taxes reference the state’s paramount duty, none of the bills creates a dedicated Paramount Duty Trust Account, for example, with new revenues only going to that account or going to the ELTA. All of these bills deposit the new revenues in the state general fund, where dollars can be spent anywhere.

- Neither of the proposed operating budgets fully funds the Big 3. So, legislators promoting new revenue are, in essence, saying Even with these new revenues, we can’t fund special education or MSOC as originally introduced. In addition, there is nothing to fund student transportation shortfalls or special passengers, or to make specific investments in areas we know benefit students to achieve their highest potential. In fact, by stopping Transition to Kindergarten enrollment for three school years, downsizing LEA in high percentage ALE districts, threatening bus depreciation on districts that are following state policy to shift to ZEV buses, reducing apportionment for the 2025-26 school year, and other gimmicks to “save the state money,” they are doing exactly the opposite.

What are the revenue bills?

House

- 2SHB 1614 would make various modifications to the capital gains tax, including technical corrections and changes to enhance administration of the tax. The bill was requested by the Department of Revenue, which indicated changes were needed following two years of administering the capital gains tax. The companion is SSB 5314, and it has passed the Senate and the House Finance Committee, and is scheduled for a public hearing in House Appropriations.

- HB 2045 would add a 1% Business & Occupations surcharge on businesses with a taxable income over $250 million, beginning January 1, 2026.

While the intent section mentions the state’s obligation to provide adequate funding for K-12 education, along with other priorities such as public safety and health care, the revenues are deposited into the state general fund. In other words, none of the new revenues are directly dedicated to the ELTA or any specific K-12 funding account.

- HB 2046 would impose a 0.8% tax on individuals on certain financial assets valued at more than $50 million, e.g., $8 on every $1,000 of the true and fair value of financial intangible assets, such as publicly traded corporate stocks. The first $50 million is exempted, along with other assets, and would begin January 1, 2026 for taxes due in 2027. The new revenue would be dedicated to the Education Legacy Trust Account (ELTA) (Section 3).

- HB 2049 would change the 101 percent revenue growth limit for state property taxes to 100% plus population change and inflation, with a capped limit of 103 percent.

For enrichment levies, the bill also would increase the maximum per-pupil limit of $2,500 per student/$1,000 assessed value or $3,000 per student/$1,000 assessed value for school districts with 40,000 or more student FTE. Beginning in the 2026 calendar year, the per pupil amount would be increased by $500 plus inflation, increasing gradually to $5,035 by the 2031 calendar year.

The bill would increase the Local Effort Assistance (LEA) threshold by an additional $200 per pupil in 2026, 2030 and 2031, and by $300 per pupil in the 2027 calendar year. In the 2028 and 2029 calendar years, LEA would not increase. According to bill sponsor Rep. Steve Bergquist, the goal is to increase LEA by $900 over the six years for LEA-eligible school districts.

For the 2028-29 school year, the cap on total student enrollment in special education would be removed. The bill also would direct OSPI to convene a K-12 Funding Equity Work Group to analyze K-12 funding formulas and explore options for revisions to the funding formula that are responsive to student needs, including economic, demographic, and geographic differences in student and community populations. The work group is to deliver recommendations for three years, beginning November 1, 2025, on how to spend excess revenues as a result of new state property tax collections.

Senate

- SB 5796 would impose a 5% tax on payroll expenses above the Social Security threshold, which is currently $176,100 a year, on employers with $7 million or more in payroll expenses. The tax would be imposed only on the payroll above the Social Security threshold, and would apply to local governments, including school districts, with a $7 million or more payroll.

While the intent section refers to the need to fully fund basic education, the new revenues are not directed to the Education Legacy Trust Account.

- SB 5797 would impose a 1% tax on individuals on certain financial assets valued at more than $50 million, e.g., a rate of $10 per $1,000 of the true and fair value of the assets if the assets are owned by a Washington resident with worldwide financial intangible assets in excess of $50 million. Taxable assets would include publicly traded bonds, stocks, exchange traded funds, and mutual funds.

Unlike HB 2046, the new income would not be deposited in the Education Legacy Trust Account, but would be deposited in the state general fund.

- SB 5798 would increase the annual property tax growth limit for state and local property taxes equal to the greater of 100 percent plus inflation and population change or 101%. The state portion of the property tax levy is dedicated to K-12 education, and consists of two parts, and each part is often referred to as part I and part II. It also would require property tax statements to list the state property tax as the “State School Levy – part 1” and “State School levy – part II.”

Advocacy in Action

- WSPTA Advocacy Committee Danica Noble represented the state association at the Senate operating budget hearing Tuesday, March 25th. Danica thanked members of the Senate Ways & Means Committee for their investments in special education and MSOC and urged them not to allow any decreases in a final negotiated budget. Listen to Danica here.

- Speak up and share your concerns with your legislators about fully funding K-12 education. If you haven’t already filled out the Action Alert, please do so today! Alert found here.

The Week Ahead – All hearings can be found on TVW – Schedule subject to change

The next cutoff is April 2, the deadline when bills must pass out of the opposite chamber’s policy committees. Check the Week 12 schedule for all of the bills up this week for public hearings or executive action.

Education (House) – HHR A and Virtual JLOB – 3/31 @ 1:30pm

- ESSB 5181 – Exec Session – Amending the parents’ rights initiative to bring it into alignment with existing law. (Monitoring)

Ways & Means (Senate) – SHR 4 and Virtual JACB – 3/31 @ 4:00pm

- SB 5797 – Public Hearing – Enacting a tax on stocks, bonds, and other financial intangible assets for the benefit of public schools. (Remote Testimony Available).

- SB 5796 – Public Hearing – Enacting an excise tax on large employers on the amount of payroll expenses above the social security wage threshold to fund programs and services to benefit Washingtonians. (Remote Testimony Available).

- SB 5798 – Public Hearing – Concerning property tax reform. (Remote Testimony Available).

- SB 5794 – Public Hearing – Adopting recommendations from the tax preference performance review process, eliminating obsolete tax preferences, clarifying legislative intent, and addressing changes in constitutional law. (Remote Testimony Available).

- SB 5795 – Public Hearing – Reducing the state sales and use tax rate. (Remote Testimony Available).

Capital Budget (House) – HHR B and Virtual JLOB – 4/1 @ 8:00am

- HB 1216 – Public Hearing – Concerning the capital budget. (Hearing is on the Proposed Substitute.)

Environment, Energy & Technology (Senate) – SHR 1 and Virtual J.A. Cherberg – 4/1 @ 1:30pm

- 2SHB 1503 – Exec Session – Furthering digital equity and opportunity in Washington state. (Support/Low)

- ESHB 1483 – Exec Session – Supporting the servicing and right to repair of certain products with digital electronics in a secure and reliable manner to increase access and affordability for Washingtonians. (Support/Medium)

Education (House) – HHR A and Virtual JLOB – 4/1 @ 4:00pm

- ESSB 5181 – Exec Session – Amending the parents rights initiative to bring it into alignment with existing law. (Monitoring)

Ways & Means (Senate) – SHR 4 and Virtual JACB – 4/1 @ 4:00pm

- SB 5195 – Public Hearing – Concerning the capital budget. (Hearing is on the Proposed Substitute.)

Appropriations (House) – HHR A and Virtual JLOB – 4/2 @ 4:00pm

- SB 5189 – Public Hearing – Supporting the implementation of competency-based education. (Remote Testimony Available).

- SSB 5253 – Public Hearing – Extending special education services to students with disabilities until the end of the school year in which the student turns 22. (Remote Testimony Available).

- SSB 5570 – Public Hearing – Supporting public school instruction in tribal sovereignty and federally recognized Indian tribes. (Remote Testimony Available).

- SSB 5314 – Public Hearing – Modifying the capital gains tax. (Remote Testimony Available).

- 2SSB 5358 – Public Hearing – Concerning career and technical education in sixth grade. (Remote Testimony Available).

- ESB 5769 – Public Hearing – Addressing transition to kindergarten programs. (Remote Testimony Available).

Finance (House) – HHR A and Virtual JLOB – 4/3 @ 8:00am

- HB 2045 – Public Hearing – Investing in Washington families by restructuring the business and occupation tax on high grossing businesses and financial institutions. (Remote Testimony Available).

- HB 2046 – Public Hearing – Creating fairness in Washington’s tax by imposing a tax on select financial intangible assets. (Remote Testimony Available).

- HB 2049 – Public Hearing – Investing in the state’s paramount duty to fund K-12 education and build strong and safe communities. (Remote Testimony Available).

Capital Budget (House) – HHR B and Virtual JLOB – 4/3 @ 9:00am

- HB 1216 – Exec Session – Concerning the capital budget.

Appropriations (House) – HHR A and Virtual JLOB – 4/3 @ 1:30pm

- HB 2047 – Public Hearing – Eliminating the Washington employee ownership program. (Remote Testimony Available).

- HB 2048 – Public Hearing – Eliminating the Washington state leadership board. (Remote Testimony Available).

- HB 2050 – Public Hearing – Implementing K-12 savings and efficiencies. (Remote Testimony Available).

Ways & Means (Senate) – SHR 4 and Virtual JACB – 4/3 @ 1:30pm

- 2SHB 1273 – Public Hearing – Improving student access to dual credit programs. (Remote Testimony Available).

- 2SHB 1587 – Public Hearing – Encouraging local government partner promise scholarship programs within the opportunity scholarship program. (Remote Testimony Available). (Support)

- SB 5195 – Exec Session – Concerning the capital budget.

Finance (House) – HHR A and Virtual JLOB – 4/4 @ 8:00am

- HB 2033 – Exec Session – Concerning the taxation of nicotine products.

Appropriations (House) – HHR A and Virtual JLOB – 4/4 @ 1:30pm

- E2SSB 5098 – Public Hearing – Restricting the possession of weapons on the premises of state or local public buildings, parks or playground facilities where children are likely to be present, and county fairs and county fair facilities. (Remote Testimony Available). (Support/High)

- SSB 5123 – Public Hearing – Expanding protections for certain students to promote inclusivity in public schools. (Remote Testimony Available). (Support)

- SSB 5327 – Public Hearing – Concerning learning standards and graduation requirements. (Remote Testimony Available). (Concerns/Monitoring)

Ways & Means (Senate) – SHR 4 and Virtual JACB – 4/4 @ 1:30pm

- HB 1796 – Public Hearing – Concerning school districts’ authority to contract indebtedness for school construction. (Remote Testimony Available).

- 2SHB 1497 – Public Hearing – Improving outcomes associated with waste material management systems. (Remote Testimony Available).

- E2SHB 1163 – Public Hearing – Enhancing requirements relating to the purchase, transfer, and possession of firearms. (Remote Testimony Available). (Support)

- ESHB 1296 – Public Hearing – Promoting a safe and supportive public education system. (Remote Testimony Available). (Concerns/Medium)

- ESHB 1651 – Public Hearing – Concerning teacher residency and apprenticeship programs. (Remote Testimony Available).